Table of Content

This charge amounts to between 1.25 – 3% of the total loan cost, depending on the length of the veteran’s service. Other VA loan disadvantages include a cap or maximum loan amount of $417,500 , some restrictions regarding eligible property types and fewer repayment options. If you plan to buy a home, you are undoubtedly considering the various types of loans to finance your purchase. You may also wonder about the differences between VA and conventional loans.

Among the most important aspect of the home, buying process is determining which loan is right for you and why. For qualified individuals, the choice to pursue a VA loan is obvious because of the many advantages offered by it, in comparison to its conventional counterparts. Now that you know the basics of how conventional, FHA and VA loans work, it’s time to consider which one fits your needs best.

Mortgage rates

They may also require a down payment if the property’s purchase price is high. However, this is more common in a competitive market with multiple bids. While VA loans cap their origination fees at 1% of the total loan amount, these fees similarly tend to only range from 0.5% – 1% for conventional loans.

For example, if you’re a first-time home buyer, you may find the mortgage qualifications of VA loans to be more accessible. If you’re already a homeowner and looking to purchase a second home or investment property, you’ll need to finance with a conventional loan. VA loans typically have lower interest rates than conventional loans and require no down payment.

Conventional Conforming Mortgage Loans

Let’s look at the difference between a VA home loan and a conventional loan to see the better option for you. They can only be used to finance primary residences, not investment or vacation properties. Like an FHA loan, a conventional loan requires mortgage insurance payments, but only if you’re putting less than 20 percent down. Additionally, the payments can be removed when you hit a certain equity level. With an FHA loan, you can’t remove MIP unless you refinance or pay off the mortgage. With a VA loan, there is no mortgage insurance requirement, but you’ll have to pay a funding fee based on the amount of the loan.

But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you. The premiums that borrowers pay go to the Mutual Mortgage Insurance Fund. FHA draws from this fund to pay lenders' claims when borrowers default.

loanOfficerStep.heading

However, for borrowers who are willing to put down 10% or more, you may be able to find a lender that accepts applicants with scores below 580. Rocket Mortgage® requires FHA borrowers to have a score of at least 580. FHA loans are intended to help people who otherwise might not be able to afford homeownership get into homes. They allow small down payments and are open to borrowers with lower credit scores. The maximum depends on the lender's guidelines, borrower's down payment and home's location. Allowable loan amounts generally are higher in places where housing is more costly.

The Department of Veterans Affairs itself doesn’t require a minimum credit score. Instead, the minimum comes from the mortgage lenders that offer VA loans. Although the credit score requirements vary, you may find that they use more flexible criteria than a conventional loan does. While conventional loan lenders will also have different credit score requirements, the minimum usually sits around 620. Rocket Mortgage® offers VA loans with a minimum credit score of 580.

Eligibility Requirements for an FHA-Insured Loan

But they’ve been much harder so you’re able to be eligible for than just Va-secured and FHA-insured financing. Given that old-fashioned money don’t possess bodies insurance coverage, these financing pose increased chance to possess lenders. Unlike FHA loans, VA loans aren’t available to the general public.

Conventional loans and VA loans are both financial products available to veterans, and each loan comes with its own benefits. Conventional loans typically offer more property options, whereas VA loans afford more down payment and credit flexibility. VA loans, however, don’t require any mortgage insurance.

VA loans do not require PMI, saving the borrower thousands over the life of the loan. PMI protects the lender if you default on your loan and typically falls off after you reach 80 percent loan-to-value . The flagship benefit of the VA loan is the VA loan's down payment requirements or lack thereof.

However, if you are interested in buying a vacation home and have the funds to put down a sizeable down payment, conventional loans may be the better option for you. Conventional loans offer more property options and flexibility for the terms of the mortgage. Additionally, these loans are open to everyone and do not require proof of veteran or active-duty status. For example, if you want to qualify for a VA mortgage, you must first get a certificate of eligibility from the Department of Veterans Affairs. Underwriting process, your lender will look at your debt-to-income ratio , which measures the amount of gross income you put toward debt each month.

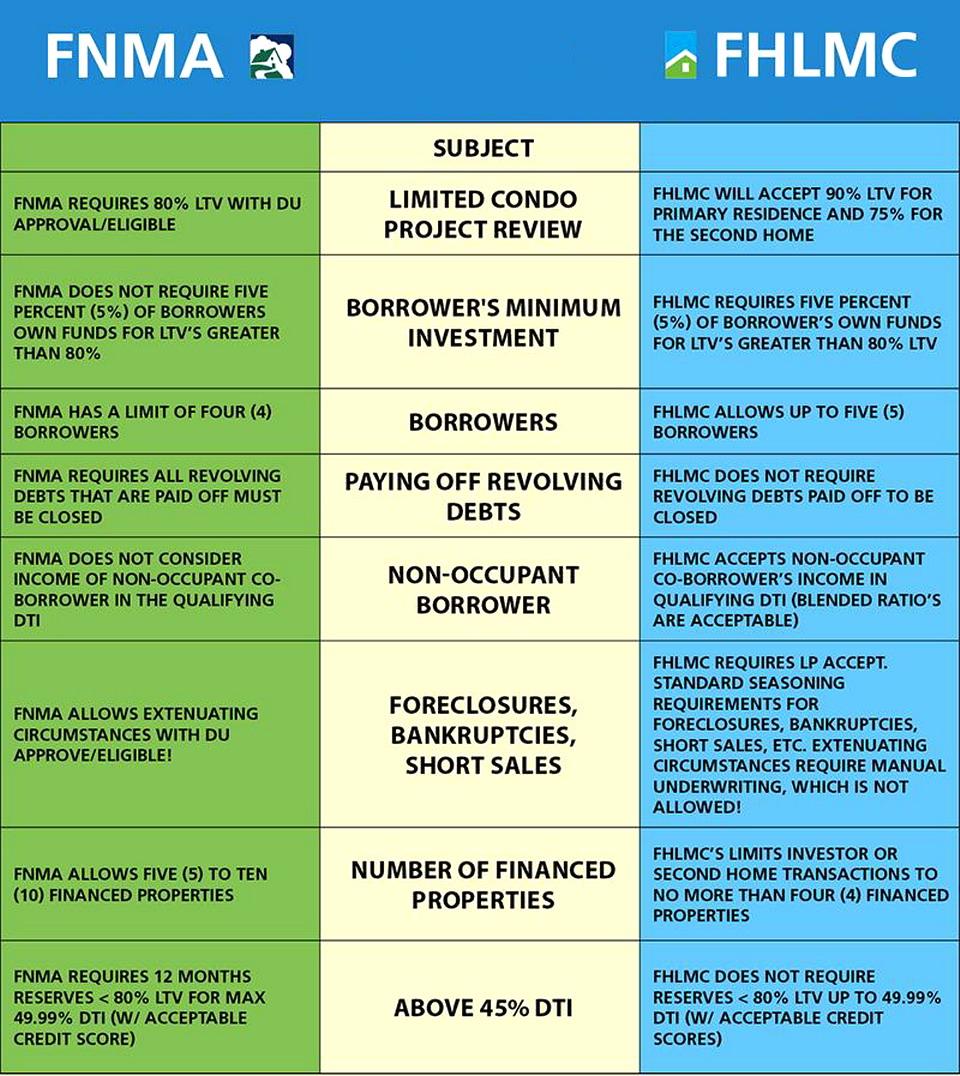

They are issued by independent financial institutions, which are able to offer more favorable terms since the VA guarantees a portion of the funds. Conventional loans that conform to Fannie Mae or Freddie Mac guidelines require a down payment of at least 3 percent for well-qualified borrowers . Department of Veterans Affairs , are available only to U.S. military servicepeople, veterans, some surviving military spouses and others who have served their country in specific ways. It’s also important to note that refinancing an FHA or VA loan can be easier than refinancing a conventional mortgage. Both FHA and VA offer streamlined refinancing, which allows you to bypass some steps in the process, like submitting some financial documentation or waiting on an appraisal.

No comments:

Post a Comment